How to Make Money with Condos

Investing in condos can be a lucrative venture if done correctly. Condos, or condominiums, are residential units within a larger building, offering investors a unique opportunity to earn money through various means. Whether you’re looking to flip a property, rent it out, or engage in long-term property management, here’s a detailed guide on how to make money with condos.

Flipping Condos

Flipping condos involves buying a property, renovating it, and selling it at a higher price. This method requires a significant amount of capital and time, but it can yield substantial profits. Here’s how to get started:

-

Research the market: Look for condos in areas with high demand and limited supply. Consider factors like location, amenities, and potential for appreciation.

-

Secure financing: Obtain a mortgage or private loan to fund your investment. Be prepared to put down a significant amount of money.

-

Renovate the property: Invest in upgrades that will increase the property’s value, such as new appliances, flooring, or paint.

-

Market the property: Use online listings, real estate agents, and social media to attract potential buyers.

-

Sell the property: Close the deal and pocket the profit.

Rental Income

Rental income is a steady source of income for condo investors. Here’s how to maximize your rental income:

-

Choose the right property: Look for condos with high rental demand, such as those in desirable neighborhoods or near amenities like schools, parks, and shopping centers.

-

Set the right price: Research the local market to determine the optimal rental price for your property.

-

Market the property: Use online listings, real estate agents, and social media to attract tenants.

-

Screen tenants: Conduct thorough background checks to ensure you’re renting to reliable and responsible individuals.

-

Manage the property: Handle maintenance, repairs, and tenant issues promptly to keep your property in good condition and maintain a positive relationship with your tenants.

Long-Term Property Management

Long-term property management involves leasing out your condo to a tenant for an extended period. This method requires less hands-on work but can still be profitable:

-

Find a reliable property management company: Hire a professional property manager to handle tenant screening, rent collection, maintenance, and repairs.

-

Set a competitive rent: Work with your property manager to determine a rent price that will attract tenants while still providing a good return on investment.

-

Keep the property in good condition: Regular maintenance and repairs will help retain tenants and prevent costly repairs in the future.

-

Monitor the market: Stay informed about local real estate trends to make informed decisions about rent increases or property upgrades.

Financing Options

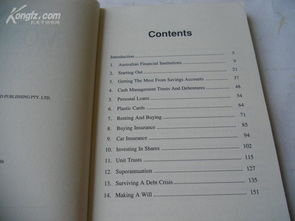

Understanding the various financing options available for condo investments is crucial. Here are some common financing methods:

-

Mortgages: Traditional mortgages are available for condo investments, but interest rates and down payment requirements may vary.

-

Private loans: Private lenders offer alternative financing options with varying interest rates and terms.

-

Hard money loans: Hard money loans are short-term loans with higher interest rates, often used for flipping properties.

-

Real estate investment trusts (REITs): REITs allow investors to invest in a portfolio of properties without owning individual units.

Case Study: Successful Condo Investment

Let’s take a look at a real-life example of a successful condo investment:

| Property Details | Investment Amount | Renovations Cost | Selling Price | Profit |

|---|---|---|---|---|

| 2-bedroom, 2-bathroom condo in a desirable neighborhood | $200,000 | $50,

|