Understanding Money Applications: A Comprehensive Guide

Money applications have revolutionized the way we manage our finances. From budgeting to investing, these apps offer a wide range of functionalities that cater to different financial needs. In this article, we will delve into the various aspects of money applications, helping you make informed decisions about which ones to use.

Types of Money Applications

Money applications can be broadly categorized into several types, each serving a specific purpose:

| Category | Description |

|---|---|

| Personal Finance Management | These apps help you track your income, expenses, and savings. They often include features like budgeting, expense categorization, and financial goal setting. |

| Investment Apps | Investment apps allow you to buy and sell stocks, bonds, and other financial instruments. They often provide real-time market data, portfolio tracking, and investment recommendations. |

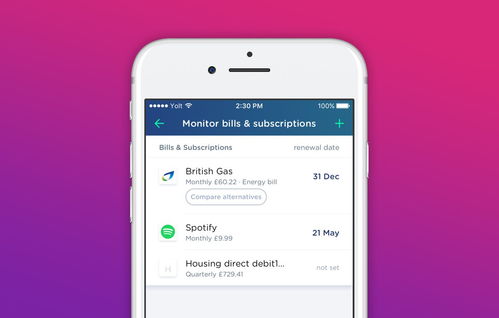

| Banking Apps | Banking apps offer a range of services, including checking account management, bill payment, and money transfers. They often provide features like budgeting tools and financial insights. |

| Debt Management Apps | Debt management apps help you track and manage your debts, including credit card balances, loans, and other liabilities. They often provide tools for creating repayment plans and tracking progress. |

Top Money Applications

Here are some of the top money applications available today:

- Microsoft Money: A comprehensive personal finance management software that offers a wide range of features, including account management, investment tracking, and budgeting.

- Money Pro mac: A personal finance management app designed specifically for Mac users. It offers features like account management, budgeting, investment analysis, and data protection.

- Money for Mac: A personal finance management app that helps you track your financial life, including account balances, investments, and budgeting.

- QuickBooks: A popular accounting software that offers features like invoicing, expense tracking, and financial reporting.

- Give Me Money: A DeFi platform that allows users to participate in various financial activities, such as lending, investing, and earning passive income.

Choosing the Right Money Application

When choosing a money application, consider the following factors:

- Features: Make sure the app offers the features you need to manage your finances effectively.

- Usability: Look for an app with an intuitive interface and easy-to-use features.

- Security: Ensure that the app has robust security measures to protect your financial data.

- Integration: Consider an app that integrates with other financial services you use, such as your bank or investment accounts.

Conclusion

Money applications have become an essential tool for managing your finances. By understanding the different types of money applications and their features, you can choose the right app to help you achieve your financial goals.