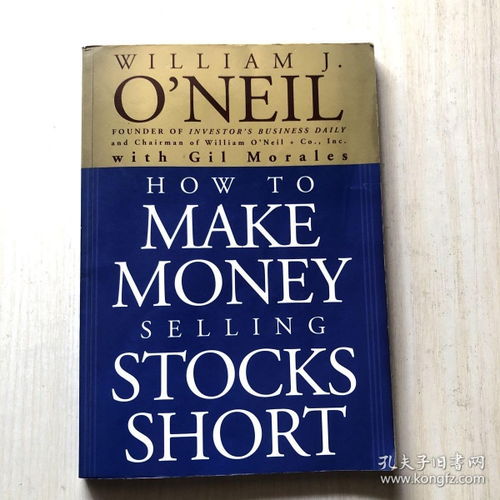

how to make money trading stocks book,How to Make Money Trading Stocks: A Comprehensive Guide

How to Make Money Trading Stocks: A Comprehensive Guide

Trading stocks can be a lucrative venture, but it requires knowledge, discipline, and a solid strategy. Whether you’re a beginner or an experienced investor, this guide will provide you with the essential information to make money trading stocks.

Understanding the Stock Market

The stock market is a place where shares of publicly-traded companies are bought and sold. It’s important to understand how the market works before you start trading. Here are some key concepts to keep in mind:

- Stocks: Represent ownership in a company. When you buy a stock, you’re purchasing a small piece of that company.

- Market Capitalization: The total value of a company’s outstanding shares. It’s calculated by multiplying the number of shares by the stock’s price.

- Dividends: Payments made by a company to its shareholders, usually in the form of cash.

- Market Trends: The overall direction of the stock market, which can be up, down, or sideways.

Choosing a Brokerage Account

Before you can start trading stocks, you’ll need to open a brokerage account. Here are some factors to consider when choosing a brokerage:

- Commissions: The fees you’ll pay for each trade. Look for a brokerage with low or no commissions.

- Platform: The software you’ll use to trade. Choose a platform that’s user-friendly and offers the features you need.

- Research Tools: Access to market data, news, and analysis can help you make informed trading decisions.

- Customer Service: A reliable customer service team can help you with any issues you may encounter.

Developing a Trading Strategy

A trading strategy is a set of rules and guidelines you’ll follow when buying and selling stocks. Here are some common strategies:

- Day Trading: Buying and selling stocks within the same day. This requires quick decision-making and a high level of risk tolerance.

- Swing Trading: Holding stocks for a few days to a few weeks. This strategy requires patience and a focus on technical analysis.

- Position Trading: Holding stocks for months or even years. This strategy requires a long-term perspective and a focus on fundamental analysis.

Understanding Risk Management

Risk management is crucial to successful stock trading. Here are some key principles to keep in mind:

- Stop Loss Orders: An order to sell a stock if it reaches a certain price, helping to limit potential losses.

- Position Sizing: Determining how much capital to allocate to each trade, based on your risk tolerance and investment goals.

- Asset Allocation: Diversifying your portfolio across different asset classes, such as stocks, bonds, and commodities, to reduce risk.

Continuous Learning and Adaptation

The stock market is constantly evolving, so it’s important to stay informed and adapt your strategy as needed. Here are some tips for continuous learning:

- Read Books and Articles: Stay up-to-date with the latest market trends and investment strategies.

- Attend Workshops and Seminars: Learn from experienced traders and investors.

- Practice with a Paper Trading Account: Test your trading strategy without risking real money.

Real-World Examples

Here are some real-world examples of successful stock traders:

| Trader | Strategy | Notable Achievements |

|---|---|---|

| Warren Buffett | Value Investing | Chairman and CEO of Berkshire Hathaway, one of the world’s most successful investors. |

| Ray Dalio | Systematic Investing | Founder of Bridgewater Associates, the world’s largest hedge

|